Detect

Retrieve suspicious activity data for uploaded documents

Looking for our page on legacy Detect?

We've moved our documentation of FTD 1.0 (our legacy Detect product) here. The Detect product described on the current page supersedes FTD 1.0 hence it's recommended to use this page going forward.

Detect empowers you to identify and interpret fraudulent activity through advanced machine-learning models. With clear, actionable signals, and intuitive visualizations, you can confidently approve legitimate loans while minimizing the risk of fraud and preventing unnecessary financial losses.

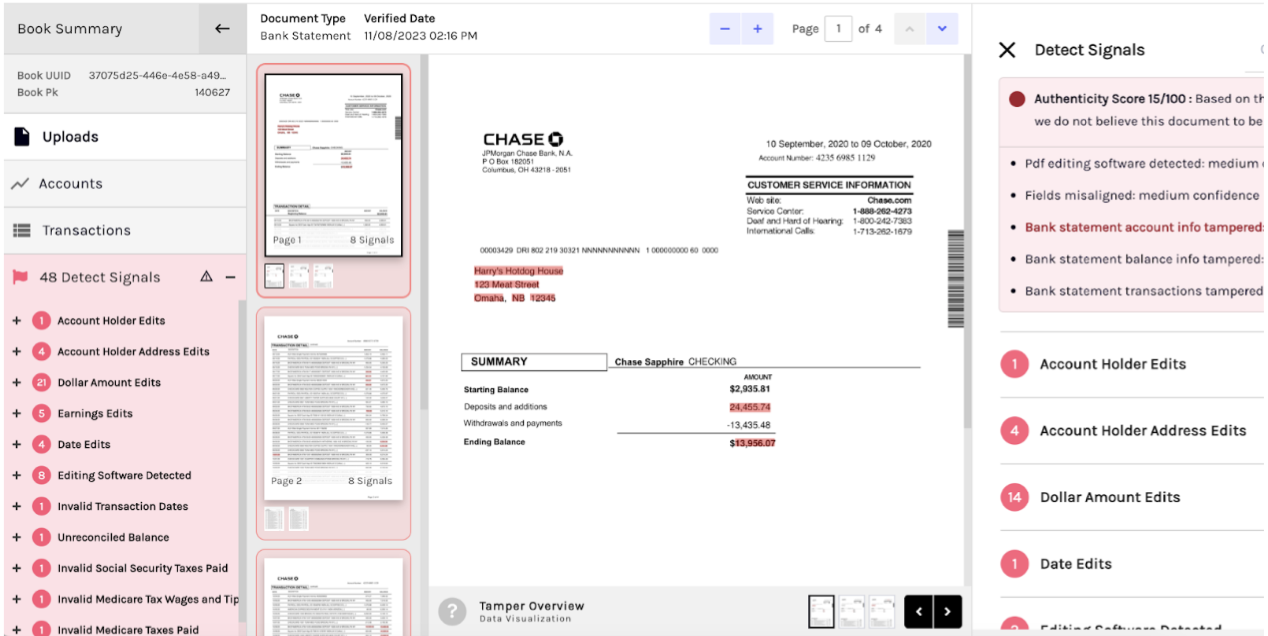

Detect provides specific fraud indicators known as signals. These signals offer contextual information that can support a fraud claim, such as positional data or edited text. Many signals are visually represented with colored highlights for easy identification.

We offer to Detect through our Dashboard and through APIs (Book fraud signals and Document fraud signals). For more information on accessing Detect, please contact your Account Manager.

Supported Documents

We support using Detect on bank statements, pay stubs, and W-2s. Other document types are not processed with Detect at this time.

Signals

Detect is designed to reduce both missed fraud and unnecessary review, but each customer’s policy and risk tolerance is different.

- False positives (over-flagging): Emphasize configurable thresholds, how customers use Authenticity Score for legacy rules and Authenticity Status for day-to-day routing, and the availability of evidence so teams can avoid blanket over-review and focus on true risk.

- False negatives (missed fraud): Emphasize the deeper forensics and serial fraud detection across documents and workflows. Recommend capturing real-world misses during pilots to tune policy and thresholds.

We use the term signal to mean a specific indicator of a fraudulent modification to a document. Some signals we can uncover include:

- Account holder name and address

- Account number

- Dollar amounts

- Dates

- Employer address

- Transaction details

- Misaligned text

- Reconciliation checks

- Online generated paystub checks

Watch out for false positives!

While Ocrolus identifies potential signs of fraudulent activity, the final decision regarding fraud is yours to make. Some flagged documents may have legitimate explanations. For example:

- Documents with multiple names could belong to someone who recently changed their name or has variations in its spelling.

- Unusual image data might result from poor image conversion by the document's owner.

- Reports of uncommon fonts could be related to the design of the bank statement itself.

We recommend manually reviewing any activity that Ocrolus flags as suspicious.

Visualizations

Most signals describe fraudulent edits to a particular region on a Document's page. Detect illustrates these signals as highlighted areas on top of the submitted document. These visualizations can be seen using Dashboard or obtained with API.

Using Detect

You can use Detect through the Ocrolus Dashboard or through Book fraud signals and Document fraud signals API endpoints. Both methods offer the same information (including visualizations) but are intended for different use cases.

All uploaded documents are automatically scanned for Detect signals, no matter how they are uploaded. Once the results are available, you can access them anytime.

Dashboard

The Dashboard is better suited for use by fraud analysts or other non-technical users. It's also good for quickly reviewing documents without needing to set up API credentials or write code to use them.

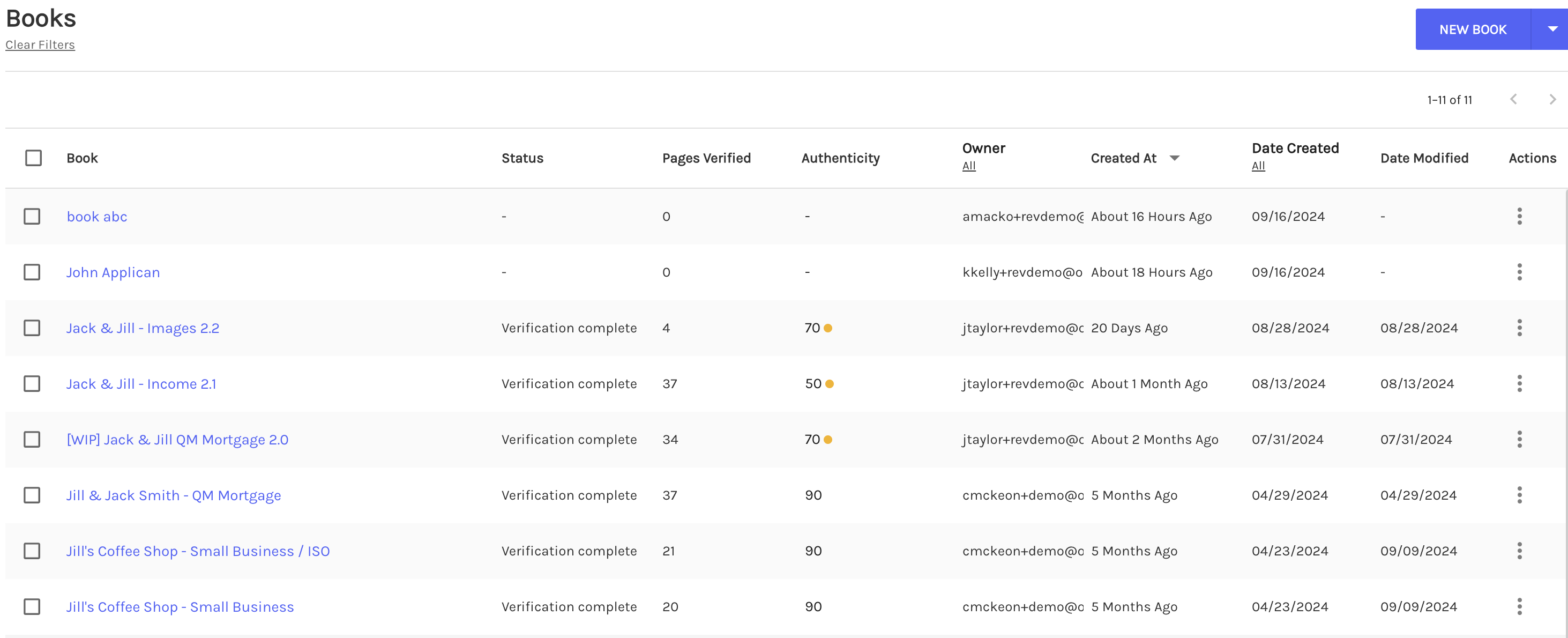

To begin using Detect through our Dashboard, perform the following steps:

-

Log in to the Ocrolus Dashboard.

-

Select a <glossary:Book> from which you want to read signals. You can create a new Book if required. To create a new Book, click on the NEW BOOK button and follow the on-screen instructions.

-

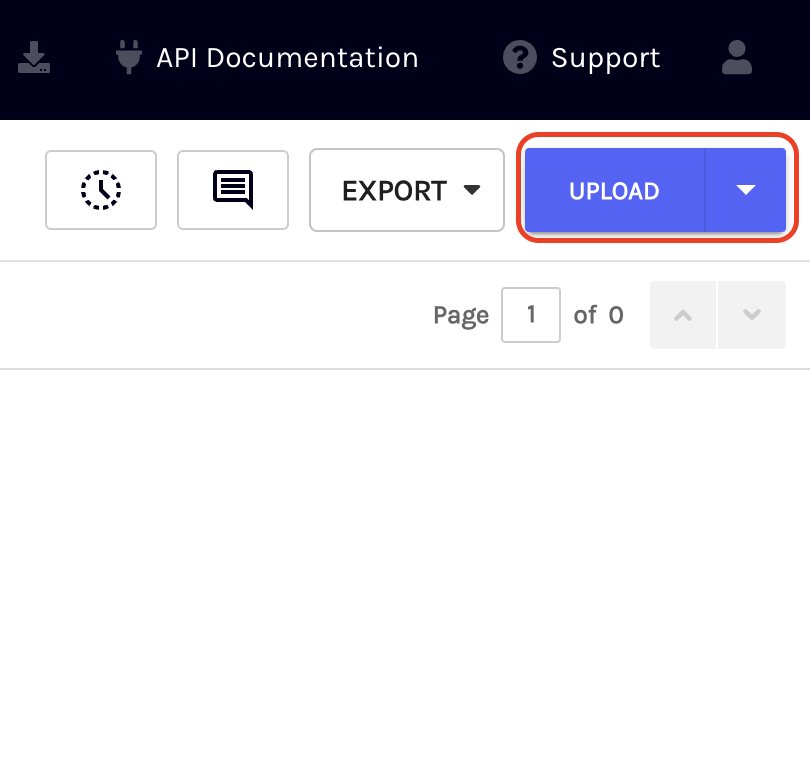

Click on the UPLOAD button.

-

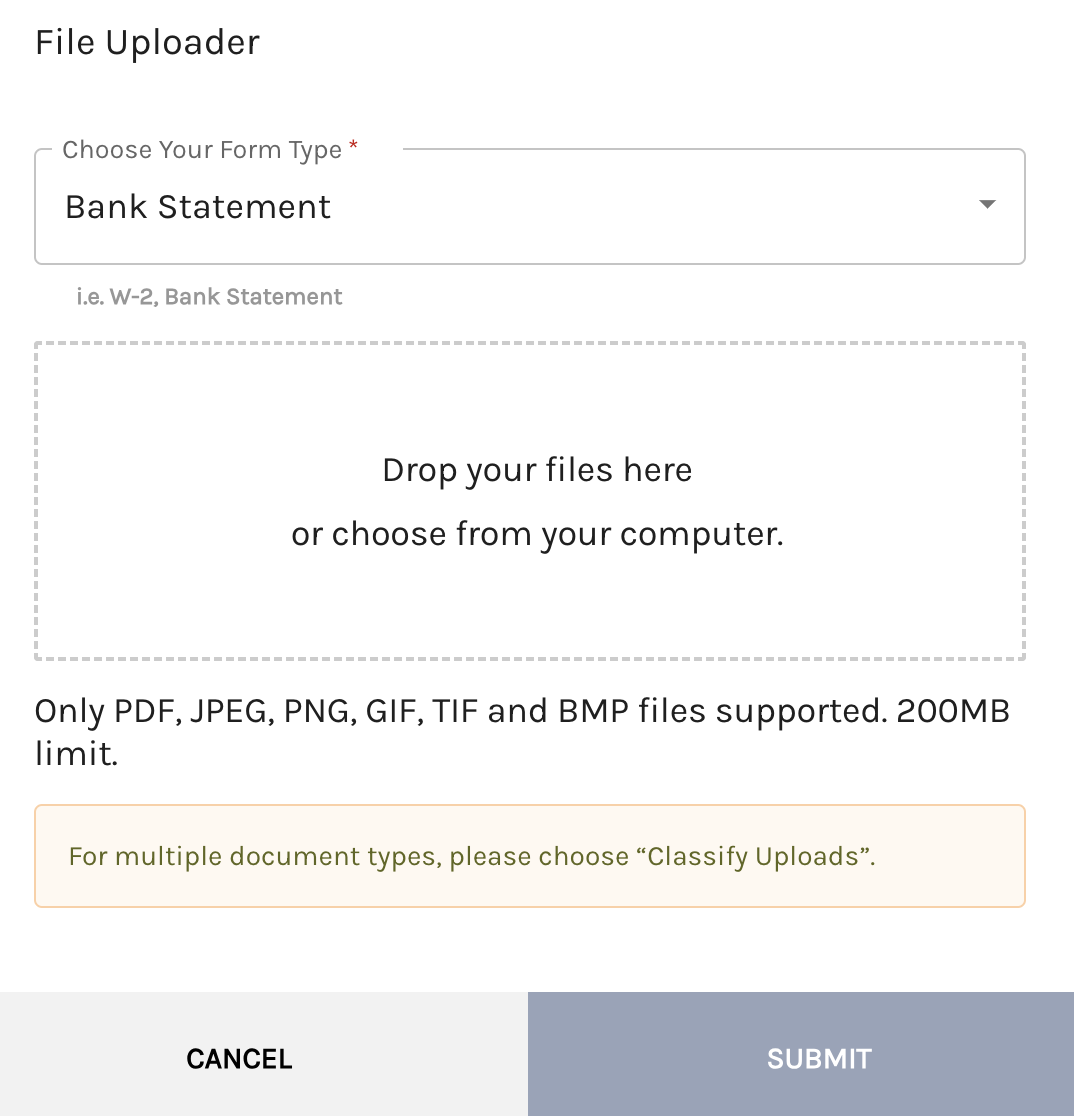

Choose your form type, browse your <glossary:Document> containing one or more pay stubs, bank statements, or W-2s to upload, and then click on SUBMIT button. Check out this guide for more guidance on using the Dashboard.

Note

Results may not be available immediately, even after the uploaded documents are captured. Check back in a few minutes, or set up a webhook to be notified.

API

To use Detect via our API, you'll need to create a set of credentials. To learn more about using these credentials, see the using API credentials section.

You can retrieve Detect signals from complete Books or from individual Documents. These endpoints provide the same information displayed on the Dashboard, including visualizations.

The API is ideal for integrating Detect into custom fraud analysis workflows, such as for analytics or internal review applications.

Webhooks

Ocrolus sends notifications to registered webhooks when specific events occur. You can register a webhook to listen for the following events:

document.detect.signal_found: Triggered when an uploaded document contains at least one fraud signal.document.detect.signal_not_found: Triggered when no fraud signals are found in the uploaded document.document.detect.unable_to_process: Triggered when Detect cannot be run on the document.book.detect.signal_found: Triggered when at least one document in a Book contains fraud signals.

E-Mail Notifications

Users are notified via e-mail whenever new Detect signals are found in any document within a Book. Such notifications are sent to the following users:

- The user who created the Book

- All users who uploaded a document to the Book

- All users with whom the Book has been shared (for non-public Books)

- All users that are part of your organization (for public Books)

If you'd like to subscribe or unsubscribe to Detect alerts, please contact [email protected] for further guidance.

Updated 4 days ago