Wage earner income

The wage-earner income is an earning derived from a borrower’s employment, typically through regular salary or hourly wages, as documented by pay stubs, WVOEs (Verification of Employment), and W2s. Each source of wage-earner income is broadly categorized as one of the following:

- Base income (hourly/salaried): All earnings that are considered regular earnings are part of the Base Income.

- Overtime: Income earned for hours worked above the standard or expected weekly hours.

- Bonus: Compensation paid above and beyond the standard income expectation, not necessarily in a predictable manner.

- Shift differential: Compensation paid at a premium pay rate for hours worked at non-traditional times, such as nights, weekends, or holidays.

- Commission: Compensation paid based on sales made or services performed.

- Military entitlements: Compensation from enlistment in the United States military.

- Miscellaneous income: Recurring employment income that couldn't be categorized.

Documents utilized

Ocrolus requires the following documents to calculate wage earner income. Anything not listed is not currently used for this purpose.

- Pay stubs

- W-2s

- Written Verifications of Employment (WVOE)

- VOE (generic) - Verification of Employment Report

- VOE (1005) - Request for Verification of Employment

Income calculation guidelines

It is recommended to adhere to the following key guidelines while doing income calculation using Ocrolus:

- Only documents from the current year and the last two years are considered for income calculation (Pay stub/VOE/W2s).

- Pay stubs/WVOEs from the current year without year-to-date (YTD) values are not considered for calculation.

- Pay stubs without an end date are not considered for calculation.

- Ocrolus prefers extracting income from pay stubs over WVOEs, but if both are available for a given pay period, the most up-to-date document will be used.

- If there is a tie between documents, the one listing the highest earnings will be selected.

- Pay stubs listing multiple bonuses, commissions, overtime, or other earnings will have those amounts combined as a single earning.

- If a pay stub clearly states Hourly or Salary, Analyze uses that information to determine the pay type. If this detail is not provided, Analyze compares the pay rate with the current pay. If they match, it classifies the pay as salary; otherwise, it defaults to hourly.

- Wage-earner income sources benefit from three years of data, though one or two years can be used with potential alerts.

- One-off payments are generally excluded from calculations, except for bonus income.

- If YTD income isn't clearly itemized on a paystub, Analyze doesn't use it for calculations. Instead, it alerts you that a Written Verification of Employment (WVOE) is required for accurate assessment.

Determining the current employer

Ocrolus looks at the Book's creation date and the ending date of each contained pay stub to determine which employers are current.

An employer is considered current if the Book contains a pay stub with an end date no more than 60 days prior to the Book's creation.

For income types that use pay stubs, those from previous years are considered part of the current employer if the names match with the current year's stubs. In such cases, older pay stubs contribute solely to calculating current income.

If no employer is recognized, whether for current or past years, Unknown is used as a placeholder, while income calculations proceed as normal.

Consider the below example:

| Book creation date | Most recent pay stub period | Is this employer current? |

|---|---|---|

| January 15, 2021 | December 1, 2020 - December 31, 2020 | Yes |

| July 3, 2020 | May 31, 2020 - June 30, 2020 | Yes |

| November 5, 2021 | March 6, 2021 - March 20, 2021 | No |

| February 8, 2021 | November 6, 2020 - December 6, 2020 | No |

If a Book contains multiple eligible pay stubs from different employers, the most recent pay stub determines the current employer.

Employment start date sourced from Encompass

Analyze pulls the borrower’s employment start date directly from Encompass to improve income calculation accuracy and reduce manual data entry. This applies to both wage-earner (borrower/employer) and self-employed (borrower/business) income, with entity matching to ensure the correct association.

The employment start date is visible in the Dashboard and can be manually edited by lenders. When Encompass is used as the source, Analyze displays a low-severity alert prompting lenders to provide supporting documentation. If a WVOE form is available, its start date is prioritized as the source of truth. This supports both Ocrolus income and Fannie Mae income start date fields.

Hourly

Income is considered to be hourly if a pay stub/VOE meets all the following conditions:

- Income is categorized under types such as hourly, PTO, and vacation.

- Both an hourly rate and the number of hours worked are specified.

Categorizing hourly earnings

Occasionally, earnings are detected that are suspected to be hourly but are otherwise difficult to classify. These earnings might use a non-standard pay code for a known income type or they might be some unusual employer-specific categorization entirely.

However, these miscellaneous earnings are counted towards hourly income if they meet certain conditions. At a minimum, they must be awarded at the same hourly rate as regular income. In addition:

- If regular and miscellaneous earnings are assigned the same non-zero hourly rate, then their sum is counted as hourly income.

- If regular and miscellaneous earnings are assigned different hourly rates, then regular earnings are counted as hourly income and miscellaneous earnings as other employment income.

- If regular earnings aren't available but miscellaneous earnings are, then it is counted as other employment income.

- If miscellaneous earnings don't meet any of the above conditions, they will be categorized as other employment income.

Calculations

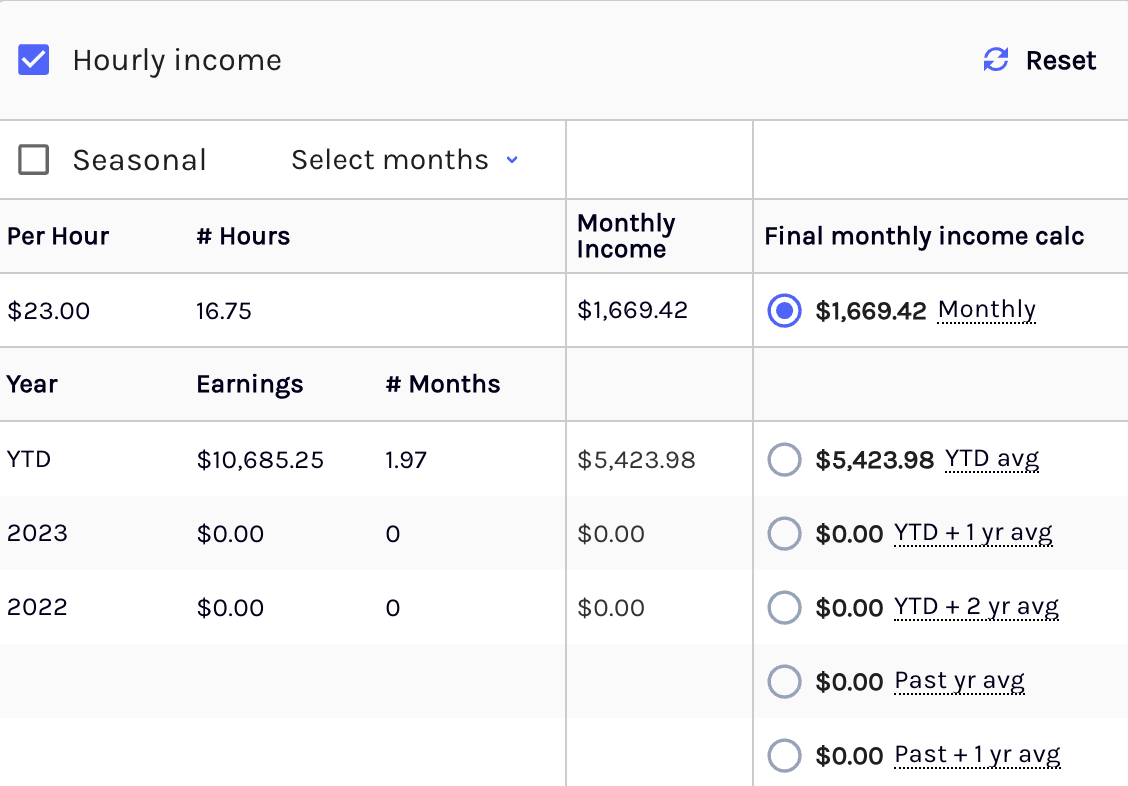

Ocrolus calculates the following income types to provide a comprehensive financial assessment:

- Monthly Period Income

- Year-To-Date Average (YTD Avg)

- Year-To-Date plus 1-Year Average (YTD + 1-Year Avg)

- Year-To-Date plus 2-Year Average (YTD + 2-Year Avg)

- Past 1-Year Average

- Past 2-Year Average

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | The lowest non-zero value among the following reported income types is used: - Monthly Period Income - Year-To-Date Average (YTD Avg) - YTD + 1 year avg - YTD + 2 year avg |

| Freddie Mac | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg |

| FHA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| VA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| USDA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg |

All computations are displayed on the Dashboard. If you prefer to use an average other than the lowest value, you can select the corresponding radio button next to the desired average.

Calculation logic for hourly income

- To calculate any of the above income values, Ocrolus prefers using WVOE/Pay stubs over W2s.

- For monthly income calculation, the weekly number of hours value is directly extracted from the WVOE/Pay stub. However if the reported value is greater than 40 hours/week, the system will cap the value to 40 hours/week.

- If both the (YTD) income and monthly income (calculated from the hourly rate) are greater than zero, and the YTD income is higher than the monthly income, then the system uses the monthly income as default income.

Salary

Any non-hourly earnings that are classified as regular, PTO, or vacation pay are counted as salaried income.

For a pay stub to be used for salary estimation, the following conditions must be met:

- The pay stub should be from the current employer, or it must be the last one given by the previous employer.

- The pay stub's pay period must have an end date no more than 60 days prior to the Book's creation.

If the current tax year has multiple pay stubs, the salary is derived from the most recent one. If this pay stub lists multiple salary earnings, their sum is considered as one income source.

Calculations

Ocrolus calculates the following income types to provide a comprehensive financial assessment:

- Monthly Period Income

- Year-To-Date Average (YTD Avg)

- Year-To-Date plus 1-Year Average (YTD + 1-Year Avg)

- Year-To-Date plus 2-Year Average (YTD + 2-Year Avg)

- Past 1-Year Average

- Past 2-Year Average

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | The lowest non-zero value among the following reported income types is used: - Monthly Period Income - Year-To-Date Average (YTD Avg) - YTD + 1 year avg - YTD + 2 year avg |

| Freddie Mac | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg |

| FHA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| VA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| USDA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg |

Note

For the Monthly Period income, the system uses gross pay value from VOE. If VOE is not recent, then the system uses the value from pay stub.

Pay frequency

Pay frequency is the time interval at which salaried income is disbursed. Ocrolus recognizes weekly, bi-weekly (every two weeks), semi-monthly (twice a month), annual, and monthly earnings. If a supported pay frequency cannot be identified, it is calculated as Not reported.

Monthly period income

The monthly income is derived from the pay frequency and earnings over that period. The earnings per period are calculated for one month as follows:

- Monthly earnings are used as-is.

- Semi-monthly (twice a month) earnings are multiplied by 2 (24 pay periods ÷ 12 months).

- Bi-weekly (every two weeks) earnings are multiplied by 2.166… (26 pay periods ÷ 12 months).

- Weekly earnings are multiplied by 4.333… (52 pay periods ÷ by 12 months).

- Annual earnings are divided by 12, which is exclusively used for WVOEs.

If pay frequency is unknown but does have an end date for a given pay stub, the value is estimated based on the year-to-date earnings.

Overtime

Any Income earned for hours worked above the standard expected weekly hours is categorized as Overtime Earning

Calculations

Ocrolus calculates the following income types to provide a comprehensive financial assessment:

- Year-To-Date Average (YTD Avg)

- Year-To-Date plus 1-Year Average (YTD + 1-Year Avg)

- Year-To-Date plus 2-Year Average (YTD + 2-Year Avg)

- Past 1-Year Average

- Past 2-Year Average

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg - YTD + 2 year avg |

| Freddie Mac | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg |

| FHA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| VA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| USDA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg |

Note

If overtime income data is not available for both current year and past year, then we do not select any value by default for overtime income. You must manually decide.

Commission

Any income earned from compensation or commissions paid based on sales made or services performed is categorized as commission income.

Calculations

Ocrolus calculates the following income types to provide a comprehensive financial assessment:

- Year-To-Date Average (YTD Avg)

- Year-To-Date plus 1-Year Average (YTD + 1-Year Avg)

- Year-To-Date plus 2-Year Average (YTD + 2-Year Avg)

- Past 1-Year Average

- Past 2-Year Average

Only reported if at least one of these values is reported

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg - YTD + 2 year avg |

| Freddie Mac | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg |

| FHA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| VA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| USDA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg |

Note

If commission income data is not available for both current year and past year, then we do not select any value by default for commission income. You must manually decide.

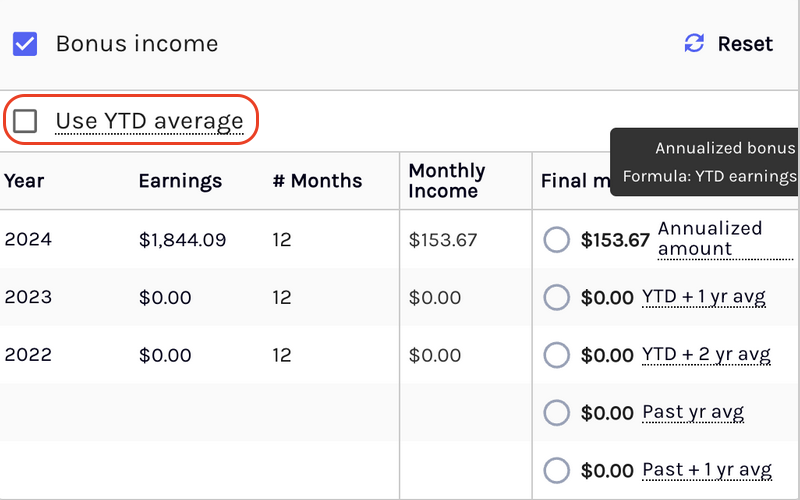

Bonus

Any compensation earned beyond the standard income expectation, and not received on a predictable schedule, is typically categorized as bonus income. For the most accurate results, provide three years of bonus data, including the current year. Two consecutive years of data are also acceptable, but will trigger a warning.

By default, bonus income is averaged over 12 months to avoid overstating income. If needed, you can switch to year-to-date (YTD)–based calculations by selecting the Use YTD average checkbox in the Ocrolus Dashboard.

Calculations

Ocrolus calculates the following income types to provide a comprehensive financial assessment:

- Year-To-Date Average (YTD Avg)

- Year-To-Date plus 1-Year Average (YTD + 1-Year Avg)

- Year-To-Date plus 2-Year Average (YTD + 2-Year Avg)

- Past 1-Year Average

- Past 2-Year Average

Only reported if at least one of these values is reported

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg - YTD + 2 year avg- Past 1 year avg - Past 2 years avg |

| Freddie Mac | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg |

| FHA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| VA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| USDA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg |

Notes

- If the bonus is unavailable for the current year but has a non-zero value for the past two years, only the past year and past two-year averages are calculated.

- If data is unavailable for both the current and previous years, all three averages are calculated, but no default income selection is made.

- For FHA and VA income guidelines, Ocrolus does not calculate bonus income if full 2 year history is not available. For USDA, full 1 year history is mandatory to calculate bonus income.

Shift differential

Shift differential is considered compensation paid at a premium rate for hours worked during non-traditional times, such as nights, weekends, or holidays.

By default, shift differential income is not included in the total monthly qualifying income unless there is sufficient history. A minimum of two years of consistent shift differential pay is required for the income to be considered eligible for inclusion.

Calculations

Ocrolus calculates the following income types to provide a comprehensive financial assessment:

- Year-To-Date Average (YTD Avg)

- Year-To-Date plus 1-Year Average (YTD + 1-Year Avg)

- Year-To-Date plus 2-Year Average (YTD + 2-Year Avg)

- Past 1-Year Average

- Past 2-Year Average

Only reported if at least one of these values is reported

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg - YTD + 2 year avg- Past 1 year avg - Past 2 years avg |

| Freddie Mac | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - YTD + 1 year avg |

| FHA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| VA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg - Past 2 years avg |

| USDA | The lowest non-zero value among the following reported income types is used: - Year-To-Date Average (YTD Avg) - Past 1 year avg |

Military entitlements

Military entitlements are considered only if the employer's name is either Defense Finance and Accounting Service (DFAS) or DFAS. The rest of this section proceeds under this assumption.

If a Book contains multiple pay stubs for the current tax year, military pay is extracted from the most recent one. In the case of overlapping pay stubs, Ocrolus projects the earnings to a monthly income and sums them up.

Military pay works a little differently!

Military pay stubs are only used for the current tax year. Military pay in previous years will be ignored, as will any non-military income from any year. Consequently, base pay is included in this section.

Calculations

These are the numbers returned:

- Entitlements : The sum of all listed entitlements, excluding base pay.

- Base Pay: Base income taken directly from the pay stub.

- Entitlements and Base Pay: The sum of entitlements and base pay.

| Income Guideline | Income Determination |

|---|---|

| Fannie Mae | Entitlements + base pay value is used as default income |

| Freddie Mac | Grossed up 25% + base pay value is used as default income |

| FHA | Grossed up 15% + base pay value is used as default income |

| VA | Grossed up 25% + base pay value is used as default income |

| USDA | Grossed up 25% + base pay value is used as default income |

Categorizing entitlements

The following entitlements are categorized using the pay codes given in their respective paystubs. This table describes the military entitlements supported.

| Entitlement on worksheet | Supported pay codes |

|---|---|

| Military Base Pay | BASE PAY, Adjusted Basic Pay, and BCP |

| Military Combat Pay | DEMO PAY |

| Military Flight Pay | N/A |

| Military Hazard Pay | HFP, IDP |

| Military Overseas Pay | OHA, COLA, CSP, CSP-P, OCONUS COLA, OEP, and Overseas COLA |

| Military Prop Pay | N/A |

| Clothing Allowance | CMA |

| Rations Allowance | BAS, RBMA, SEA, SepRats, SMA, SR, and SRA |

| Variable Housing Allowance | VHA |

| Quarters Allowance | BAH, BAQ, and TQSA |

| Other Allowance | BRA |

Employer recognition

Military employers are identified using a configured list and pattern-matching logic. Recognized names include:

- DEPARTMENT OF DEFENSE

- DEFENSE FINANCE AND ACCOUNTING SERVICE (DFAS)

- U.S. ARMY

- U.S. NAVY

- U.S. AIR FORCE

- U.S. SPACE FORCE

- DEPARTMENT OF THE ARMY

- Other standardized variations

Regex patterns support flexible detection across all known naming conventions.

YTD itemization rule

Military pay stubs are exempt from the YTD itemization rule and related alert logic. The rule is applied only when both of the following are true:

- The paystub includes earnings beyond regular base pay (e.g., bonus, overtime, commissions, or other variable income).

- YTD earnings are not itemized.

If income is exclusively military, no alert is displayed. The alert text requires a WVOE to break down non-itemized income when applicable.

Military pay stub handling

Military pay stubs are processed using specific logic:

- YTD adjustment logic is not applied.

- Entitlement names are normalized by treating hyphens and underscores as spaces.

- Drill Pay is included under Other Allowances.

- Combat Pay is not displayed.

- Retention Bonus is not included in Other Allowances.

Miscellaneous income

Employment-based income occasionally defies proper classification. For our purposes, any source of recurring income that doesn't fall under one of the other supported categories is calculated as described on this page.

Note

- In practice, uncategorized income is generally one of the other types of income supported, but categorized on the provided documents in a way that isn’t recognized. As a consequence of ongoing improvements to our product, a given unrecognized income source may eventually be classified differently.

- The default selection of income is disabled for miscellaneous income.

Updated 3 months ago